When you yourself have high a fantastic debts otherwise balances in your borrowing payday loan Manzanola cards, anticipate often purchasing him or her off as much as possible ahead of making an application for the mortgage

Within Clover Financial, we have use of over forty federal and you may regional loan providers across the Canada along with significant financial institutions, alternative lenders, and personal mortgage lenders. Which means you don’t need to travelling far to get the financial that you might want.

Whether you desire a home loan in order to combine multiple costs towards borrowing cards on the one easy payment per month, or if you are utilizing it as a payment for purchasing good the real-estate, all of these lenders commonly gladly deal with your because the a reported income applicant. These businesses offers great aggressive changeable otherwise repaired mortgage costs and you will great label alternatives, depending on additional points. Also a few of the biggest financial institutions that individuals manage is starting to take on stated money mortgage software. E mail us by email address, mobile phone, otherwise thanks to our very own online E mail us mode for more information.

When you are thinking-operating otherwise a partner otherwise holder off a corporate, up coming of a lot banks will not approve your for a home loan or home refinancing, even although you is an effective AAA consumer. Since you could be revealing your earnings into the a non-antique way to save with the income tax, the banks will often moments place you owing to an extended and you may tiresome process just to deny your during the really prevent out-of they. Protecting home financing if you’re being self-working is somewhat more complicated however it is possible. On the right information of a trusted mortgage agent in the Clover Home loan, you can get approved with ease and get AAA pricing in one of more than 40 loan providers that we have the ability of working with.

You can even potentially have fun with an element of the arises from their mortgage so you can combine loans, like you perform in a debt consolidation home loan

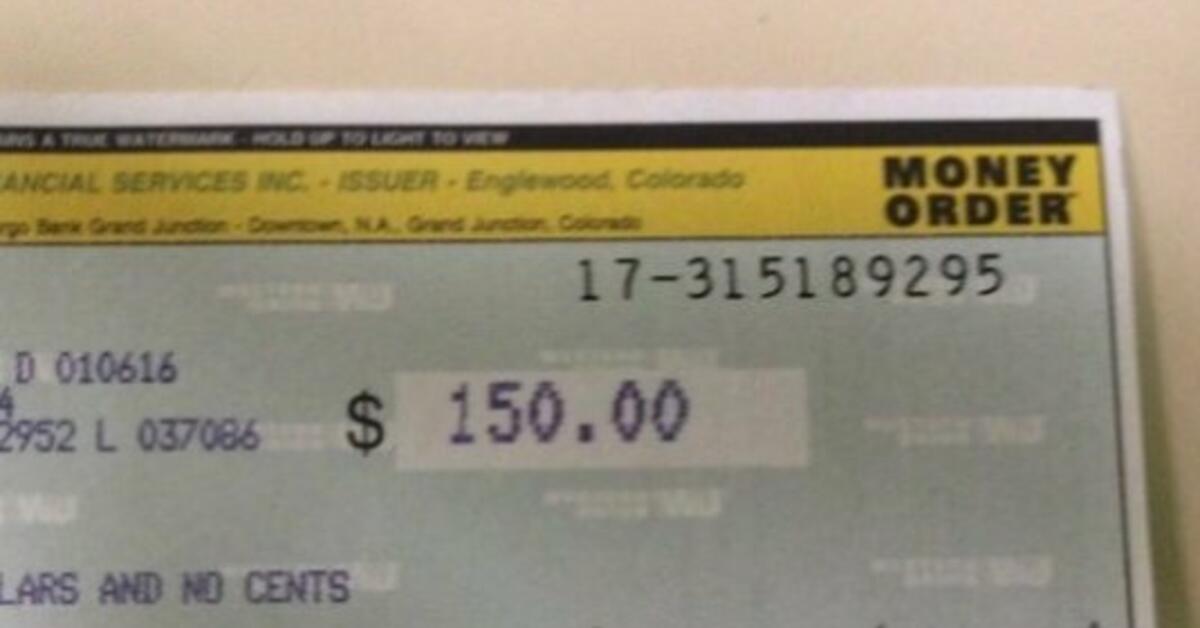

So you’re able to assess somebody’s income, really banking institutions, such as Scotia Bank, or any other old-fashioned loan providers just take into consideration the common out-of the most up-to-date two years of income stated on the web 150 of one’s borrower’s a couple most recent taxation statements. A lender which is taking regarding stated income home loan programs usually in some cases look at the average of your own past 2 yrs of the disgusting reported money ahead of income tax create-offs. At times, get a hold of lenders encourage thinking about the most other sources of income and additionally earnings regarding top operate such as for instance Uber riding money, dollars earnings, and more. The newest Gig Savings, whilst is demonstrated inside a recently available news article function 2019 as possible comprehend inside Chance Journal, means far better selection whenever trying to get a mortgage. At this particular rate, this new concert benefit you will become the heart of working globe.

Many types of loan providers needs your credit report and you may borrowing rating into consideration when examining the job. A loan provider can view large an excellent expenses because a greater chance on their money.

One of many trick benefits to are self-employed or getting a firm inside Canada is that you are able to produce out-of certain genuine organization expenditures, for example team travelling, organization judge costs, corporate degree, and you can company dinners, that might gather on the individual otherwise business handmade cards. A regular salaried staff member cannot typically have accessibility the fresh exact same advantages.

The fresh right up top in order to creating off this type of expenditures if it your can save to the quantity of income tax which you shell out. The fresh draw back would be the fact when making an application for a mortgage otherwise mortgage due to a bank, this may reduce sized mortgage otherwise mortgage which you normally be eligible for therefore the rate of interest disregard you to definitely a financial you will make you.